The Digital Innovation of the present period is demanding more simple ways to discover things including a business that provides satisfaction for customers and companies.

The economic growth of social and professional experience of people’s lives is slowly focused on advanced technology such as Artificial Intelligence. The business-like real estate, e-commerce, manufacturing, and transportation, entertainment, etc are being ready to adopt artificial intelligence helps to transform the operations held in the sectors.

Nowadays people are more familiar with advancements that create easy methods to operate any business in simple logic. One of the fine technologies that make sense in all business is AI.

What is Artificial Intelligence?

AI is part of computer science that helps to act like a human brain to perform tasks such as reading, writing, analyzing the data collected from customer’s queries. This type of technology is used in devices that collect and analyses the data used to make analysis reports used for future endeavors for business growth.

The Core Components of Artificial Intelligence

Machine learning, deep learning, chatbots, and Natural language processing are the features of AI technology that help to drive more business for companies, where NLP helps to conversion with customers to respond with their preferred languages. Machine learning is used to train devices or systems with the help of past or present data produced by businesses.

Chatbots are automated machines that are programmed devices used to communicate with customers instantly and help to increase engagement from potential customers. ( Improves retention, ROI, and loyalty )

How Does Artificial Intelligence Work?

Advanced AI will be the next future for financial applications that handle unstructured data such as videos, images, and real-time data that are produced from devices or market activity.

The AI algorithm prevents fraud detection, and credit risks and recognizes the deception methods in the sectors. This made more demand for Artificial Intelligence Companies to produce high-quality services for their clients in their business.

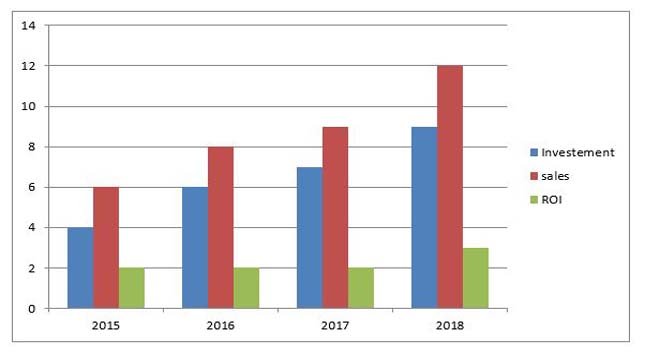

AI Market Trend

How it Impacts in Financial Services

Financial services are the most important business that decides the fate of the country. Nowadays we use mobile apps to transfer money from one device to another device that needs intelligence to track every report produced by customers.

Financial Sectors such as Banking are hiring mobile app development companies to adopt mobile apps for their business. Combining mobile apps with artificial intelligence helps to reduce the efforts of human tasks such as risk management, daily insights, suggestions, trading, and interactions.

Advantages of Implementing AI in the Financial Sector

Customer Support

Customers always prefer instant response from services provided by banking, which enables them to enhance loyalty to companies. Already most of the banking and financial systems are updated with advanced technology like Artificial Intelligence.

The virtual assistants help to create voice responses with customers through mobile apps. Those AI services in Banking support a lot for customer benefits.

Fraud Detection

Because of advancements customers are influenced to perform online transactions from one bank to another bank. However, Artificial Intelligence mobile apps help users to prevent fraud from cybercrimes such as cybercrime.

The real-time feature of AI will support the banking system to safeguard the environment of banking services. The modern features of AI notify users with identification reports of suspicious activity.

Advanced Insights

The automation of machines or devices collects data from customers which are used to produce useful insights for banking sectors that help for better productivity. The algorithms can consume and analyze the bulk of data at the expectation level. The rapid growth of AI can drive more efficiency to financial services and offer personalization for customers.

Chatbots:

Chatbots are automated devices that are used to replace human interaction at work without human interference. The chatbot technology can handle complex situations, where chatbot apps can deliver responses at one time for bulk queries, as it saves time and money. Chatbots are widely adopted by banks to develop customer relations at an individual level.

Conclusion

With such benefits, it is almost assured that the bulk of financial services will utilize machine learning algorithms to stay competitive; however, there are concerns as to how this could perform a major role in the expectation.

As it proceeds to receive and develop, the decision-making abilities in which it operates can create difficulties. One of the best AI companies in Bangalore, DxMinds produces the best AI solutions for customers that hugely impact business growth.

AI will be the perfect match for the financial sector, and help with forecasts that make digital core decisions. The success of financial services hugely depends on predicting markets to analyze the data to increase the speed and accuracy of banking services.

AI is so important when it comes to maximizing possible gain, especially when it can collect so much information about the business environment and affect risk situations.